One of the leading cryptocurrency mines, and at the same time the second largest publicly listed BTC holder, is making an abrupt sale of its resources. These, in turn, have not been liquidated since October 2020. Should this be a warning signal for the market?

Sudden sale of Bitcoin

The last six months have been a very difficult period for cryptocurrency mines, which have repeatedly faced serious problems. Many of the entities stopped operating forever, while others underwent major restructuring. At the time, however, little was said about Marathon, the second largest publicly traded holder of BTC. The miner in question, meanwhile, decided to sell a significant portion of its Bitcoin holdings for the first time in more than two years. The situation has stirred the environment.

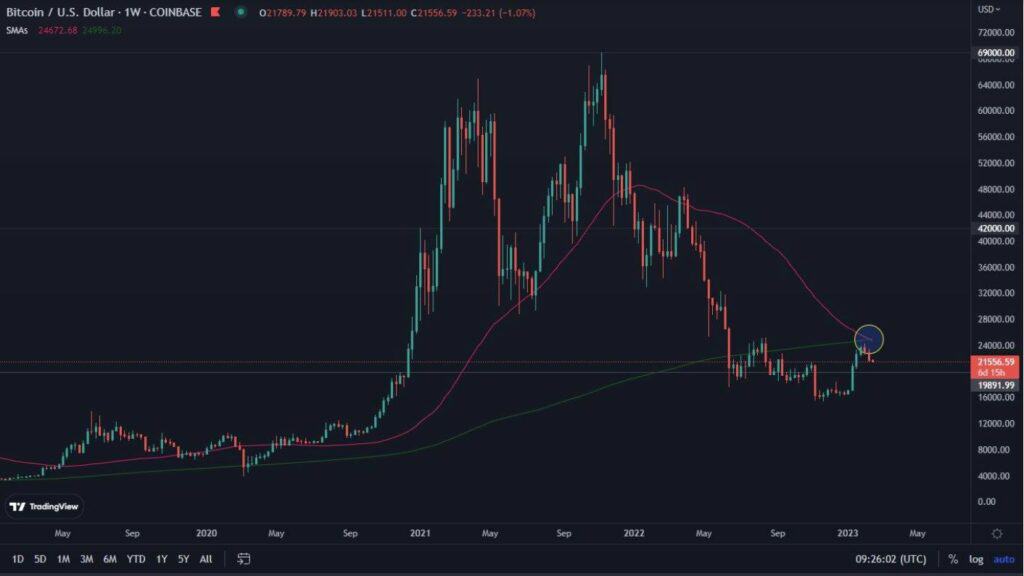

According to a report published on February 2, Marathon liquidated 1,500 BTC in January, gaining $35.3 million by doing so.

The unrest, and the rumors it caused, were quickly quelled by the Vice President for Corporate Communications. Charlie Schumacher reported that the decisions to sell were not prompted by any problems the company could potentially face.

Marathon has a clear goal

Schumacher explained that Marathon has for a long time been very bullish on the long-term prospect of Bitcoin’s development and adoption. As a result of this, the company has been reluctant to make sales at times when its mining was declining. Nevertheless, entering the new year was the moment when the decision was made to build a so-called “war liquidity dam.” It was to consist of both BTC and cash reserves. This goal, as you can see, is being realized.

In doing so, Schumacher revealed that the lack of previously observed BTC sales was the result of the company’s adopted long-term development strategy. One of the key factors was the company’s long-standing low headcount, which at the time of this writing stands at 32 people.

Significant growth in Bitcoin mining

The data presented by Marathon further indicates a significant increase in BTC mining. In January 2023, the miner managed to acquire 45% more assets compared to December 2022. This translates into an exact number of 687 BTCs dug up.

Marathon CEO Fred Thiel commented on the result:

“The improvement in our Bitcoin production was primarily the result of our team’s ability to work in tandem, with a new hosting provider, in McCamey, Texas, to resolve maintenance and technical issues at the King Mountain data center that dampened our Bitcoin production in the fourth quarter of 2022.”