According to an official announcement earlier this year (January 4, 2022), the U.S. Securities and Exchange Commission has decided to delay issuing a final decision on NYDIG’s proposed Bitcoin (BTC) spot ETF fund. What is the SEC and why are they delaying the Bitcoin ETF fund? This is what we discuss below.

What is the SEC and why are they interfering with the decision on the Bitcoin (BTC) ETF from NYDIG?

Before we address the reasons for the delay in the decision on the spot Bitcoin ETF from NYDIG, we need to explain who the SEC and NYDIG even are. The SEC is the U.S. Securities and Exchange Commission, an independent body of the U.S. federal government whose main purpose is to enforce laws against market manipulation. NYDIG, on the other hand, is the U.S. subsidiary that manages the assets of Stone Ridge Holdings Group.

What is a Bitcoin (BTC) spot ETF?

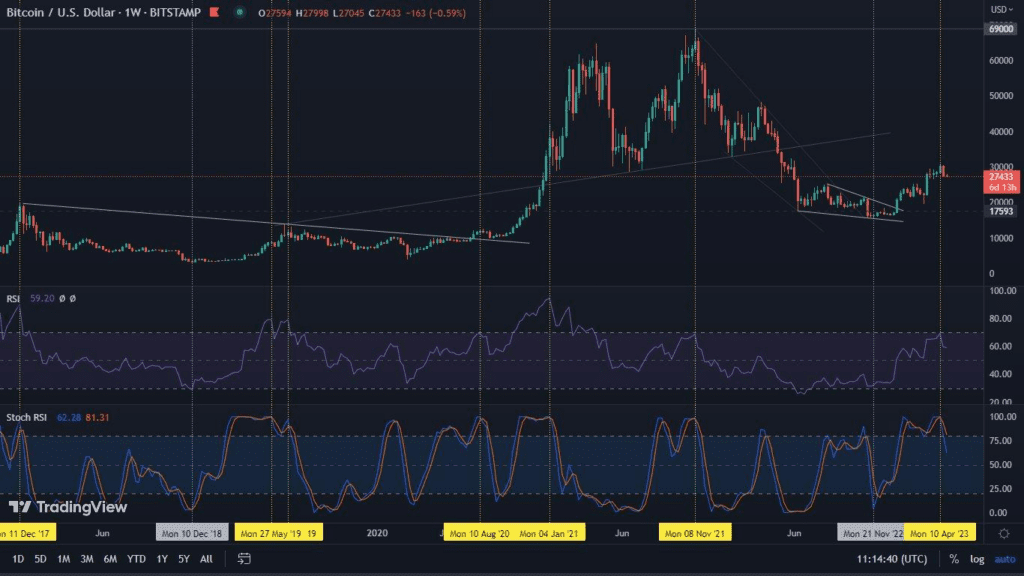

A spot fund is a fund that operates on the same market as the spot market (sometimes the term “physical market” is used instead of “spot”). Operations in such a market are executed on an immediate, rather than deferred, basis. A Bitcoin ETF based on the spot market tracks the actual price of the Bitcoin (BTC) asset. In this way, investors are exposed directly to BTC with a regulated and well-known investment product, an ETF fund. However, it is important to note that in this case, investors are not buying the underlying asset, BTC.

Why is the SEC postponing its decision?

Based on historical data, the U.S. Securities and Exchange Commission in most cases postpones a decision on bitcoin ETFs for as long as possible. The original deadline to consider a fund case from NYDIG would have passed on January 15, 2022, however, as things stand now, it passes on March 15, 2022. The SEC argues its decision on the basis of needing more time to consider the proposal and read comments on it.

Recently, the SEC has already approved several similar proposals. These include Bitcoin (BTC) futures from ProShares or VanEck. Meanwhile, at the end of 2021, the SEC rejected two proposals for new BTC-based investment vehicles from Valkyrie and Cryptoin. What decision will the SEC make this time? We will keep you updated!