Sam Bankman-Fried gave an interview to Forbes reporters in which he pointed out the problems currently facing the cryptocurrency segment. According to him, some exchanges are insolvent, but this has still not been disclosed by them.

Third-tier exchanges

The drama experienced by the Terra ecosystem, as well as the situation around BlockFi and Voyager Digital, are prompting participants and observers of the market to widely discuss its condition. One of the most interesting discussions is undoubtedly the interview that FTX Exchange CEO Sam Bankman-Fried gave to Forbes magazine.

The beginning of the conversation centered around BlockFi and Voyager, as it turns out that both entities have received a gigantic cash injection from Bankman-Fried. Total loans to keep them afloat amounted to $750 million. FTX’s CEO sees the deal as a higher-order mission and said:

“We are willing to do a slightly worse deal if necessary to stabilize the situation and protect customers.”

This kind of activity is not only to show goodwill, but also to keep the cryptocurrency industry alive and try to prevent further escalation of avalanche bankruptcies. SBF feels an obligation to help. However, as it points out, not everyone deserves it:

“There are companies that are already too far behind and there is no point in supporting them. There are third-tier exchanges that are already secretly insolvent.”

Uncertainty around miners

Nearly 600 lesser-known exchanges are based in the United States, Bankman-Fried believes. They are supposed to offer high leverage, which can have a disruptive effect not only on investors but also on themselves.

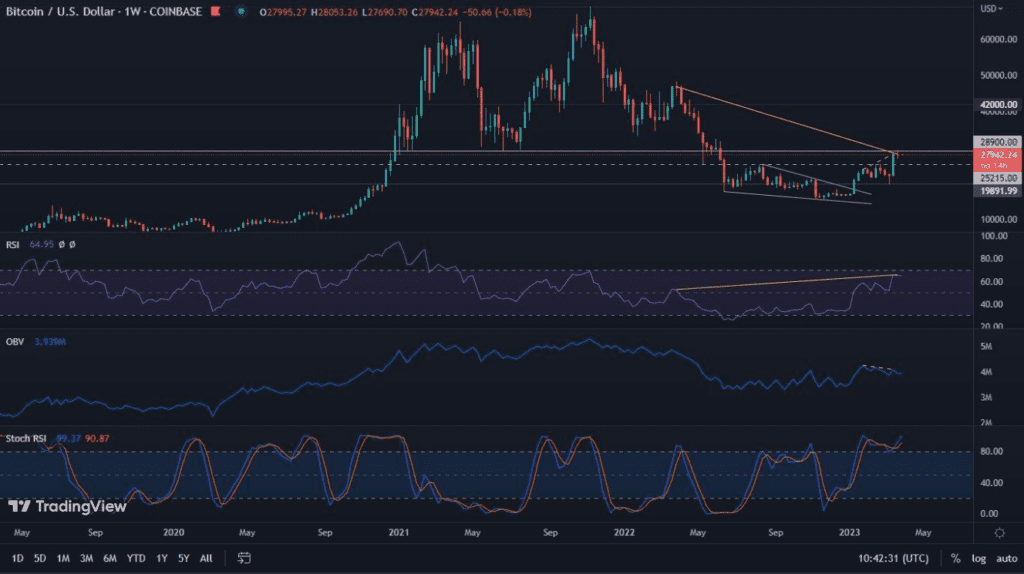

The FTX CEO also decided to comment on the condition of the mining sector. It is clear that miners’ revenues have clearly declined. Looking through indicators, they are lower than the costs incurred. This manifests itself, among other things, in the fact that miners recently liquidated more Bitcoin than they mined. According to Bankman-Fried, this trend may continue for some time to come.

Security from different perspectives

There was also an interesting thread about security, which in addition manifested itself in several different aspects. The first is its decline in the Bitcoin network, which is due to a weakening of the hash rate and, in doing so, also a reduction in the energy used by miners. This is also expected to have a direct impact on the health of companies that show Bitcoin on their balance sheets.

It has, however, dispelled doubts about Tether. The largest stablecoin to date, it has been the subject of much discussion regarding its security. According to Bankman -Fried:

“I think the really bearish opinions about Tether are wrong…. I don’t think there is any evidence to support them.”