The launch of a Bitcoin ETF from Grayscale Investments may be closer than expected. A federal court has ruled that the U.S. Securities and Exchange Commission (SEC) must reconsider an application to create a Bitcoin-based exchange-traded fund (ETF). While this victory is a step in the right direction for Grayscale, it does not automatically mean a green light for the country’s first Bitcoin spot ETF.

Grayscale ahead of chance for catch-up against SEC

Judge Neomi Rao of the U.S. Court of Appeals for the District of Columbia ruled that Grayscale’s proposed Bitcoin-based ETF was “materially similar” to already approved exchange-traded products, such as Bitcoin futures. This, in turn, means that the SEC’s argument that it lacks the means to prevent market manipulation is not enough to reject the proposal. The court’s decision states that the SEC must re-examine the issue and make a reasoned decision.

However, this is not the end of the challenges. The SEC has the option of appealing the court’s decision, which could slow down the approval process. Still, experts point out that this victory for Grayscale could mark the beginning of a new chapter for Bitcoin investment. Tim Bevan, CEO of ETC Group, comments that “spot BTC ETFs are coming to the United States,” suggesting that while the SEC may appeal, the growing acceptance of such products could move the market in a different direction.

A victory that many stand to gain from

The court’s decision may also affect other entities that have sought approval for spot ETFs on Bitcoin. BlackRock, ARK Invest, Bitwise Asset Management and others are waiting for the green light from the SEC. Meanwhile, the court’s ruling creates pressure on the Commission to carefully review all applications.

Alex Adelman, CEO of Lolla, notes that this ruling will “put new pressure on the SEC,” suggesting that the rise in BTC prices is a sign of confidence in Bitcoin-based investments. It also opens up new opportunities for investors who want to get involved in spot ETFs in the United States.

Will the United States follow the rest of the world?

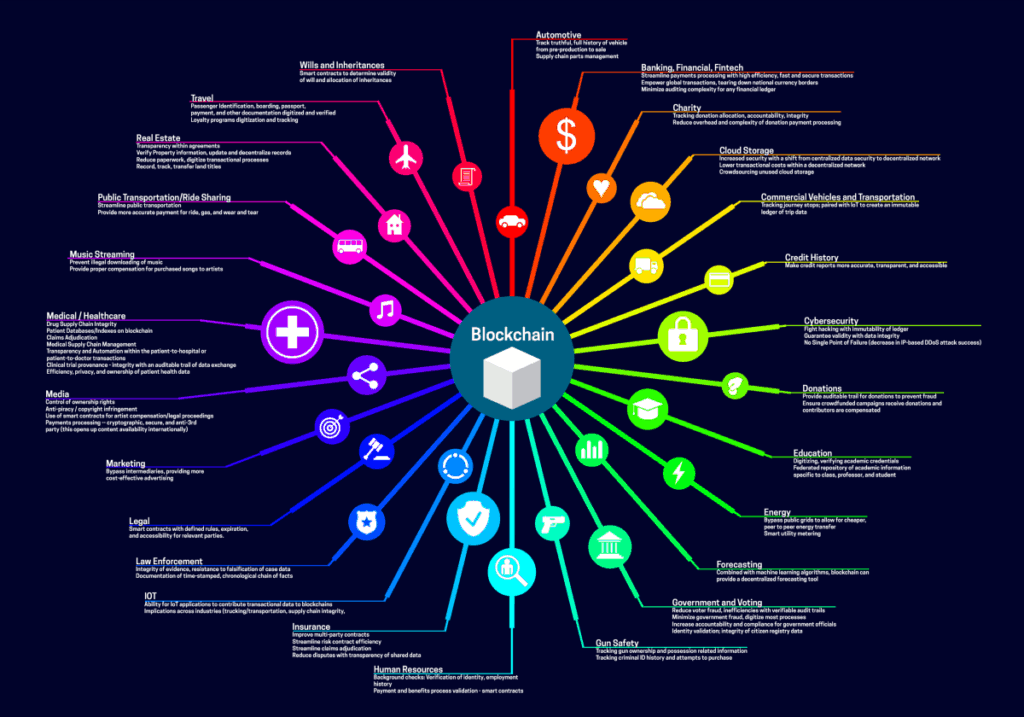

Regardless of the next steps, this court decision opens the door for new innovations in the cryptocurrency sector. Whether the United States will keep up with the trend or fall behind now depends on the SEC’s further actions and the overall shape of the cryptocurrency market. One thing is certain – growing investor interest and Grayscale’s victory are milestones on the road to greater acceptance of Bitcoin as an investment asset.