CryptoLaw’s creator, and XRP supporter, John E. Deaton, as well as Jeremy Hogan assure the community that Ripple’s eventual win over the SEC, could add a lot to another important proceeding. They pointed here to Coinbase, which was sued a few days ago, and whose defense, thanks to the XRP-related case, is entitled to rise to a much higher level.

Ripple will affect the outcome of the proceedings between the SEC and Coinbase

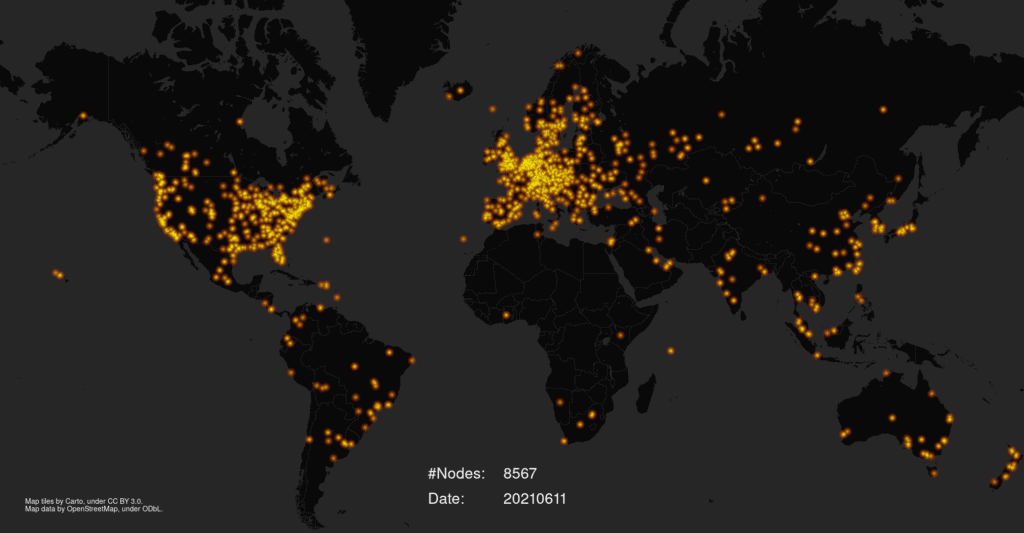

It is often the case that rules and avitics in business are not clearly defined, making it difficult to pinpoint exactly what is allowed and what is not. The effect of this is that Ripple cites the words of Bill Hinman, former SEC director of the Division of Corporation Finance, in its conduct. Hinman stated in 2018 that assets on sufficiently decentralized networks, such as Bitcoin or Ethereum, are not considered unregistered securities. That’s why many people did not hide their surprise when the SEC decided to act against Ripple because of XRP.

Attorney Jeremy Hogan, as well as John Deaton, speaking on Twitter, stated that the SEC’s case against Ripple will affect the outcome of the Coinbase trial. In their recent tweets, they pointed out that the SEC approved Coinbase’s IPO based on the same information that it is now putting into question. If Judge Analisa Torres rules in favor of Ripple in its case with the SEC, Coinbase would be in a more solid position to fight the agency’s accusations.

SEC vs. cryptocurrency market

A recent report revealed that Coinbase, a leading cryptocurrency exchange from the United States, has received a notice from the SEC. According to sources, the agency is planning to carry out enforcement actions against the exchange, which will involve some of the assets listed on the platform.

However, according to Deaton, the Coinbase exchange will not be the only entity to receive such a document. The attorney suspects that the agency aims to “squash the market” so that older financial institutions can gain a larger share of the cryptocurrency space.

Lack of clear rules for cryptocurrencies

In business, it is crucial to have clear rules and guidelines, and a lack of clear regulations can lead to confusion and problems. Ultimately, fairness and clarity help avoid unnecessary disputes and hassles.

Unfortunately, SEC officials don’t seem to know this. In recent months, they have notoriously attacked crypto market players without sufficient legal grounds to do so, or even, as in the case of Coinbase, contradicting their earlier decisions. Is this really a concerted attack on the industry? Or perhaps a smokescreen against a possible defeat in the lawsuit against Ripple? We will certainly find out soon.