Billionaire Paul Tudor Jones once again made a guest appearance in the CNBC studio. In the interview he gave, he indicated that bitcoin is winning the battle with gold for the title of inflation hedge.

No illusions

The problem of inflation is gaining momentum. Because of this, we often hear about the need to hedge one’s wealth. Until now, gold was considered to be the best asset to store value, which often in times of any crisis gained in value and provided its owners with a peaceful night’s sleep. Recently its condition has been slightly weakening. Therefore, some say that Bitcoin, due to its properties, gives a better chance to survive difficult periods.

One person on this side of the barricade is billionaire hedge fund owner Paul Tudor Jones, who is a frequent guest on CNBC’s Squawk Box program. During Wednesday’s interview, host Andrew Ross Sorkin recalled a conversation he had with the billionaire a few months earlier. In it, Tudor Jones informed that he considers Bitcoin as a hedge against inflation. The question was asked whether he would confirm this thesis in the presence of such significant increases in the value of cryptocurrencies. The billionaire was under no illusions and responded as follows:

“Look, the cryptocurrencies in my portfolio are in the single digits. I have a small position in our fund. I think we are moving in an increasingly digitized world. Clearly there is a place for cryptocurrencies and clearly they are winning the race against gold right now. So yes, I think it would be a very good hedge against inflation. I would choose them over gold at the moment.”

This is quite an important voice in the public discourse, where as we know opinions are divided. Moreover, still relatively few billionaires admit to owning cryptocurrencies. Calling them an inflation hedge that is better than gold is a bold and not necessarily politically correct move.

Bitcoin and gold – similarities and differences

The most significant difference between Bitcoin and gold is its form. First of all, gold is a tangible asset, which cannot be said of any cryptocurrency. Furthermore, gold can and does exist in limited quantities, yet these quantities are still unknown, and can easily be increased in the event of any need. In this regard, Bitcoin is a highly deflationary asset with only 21 million coins programmed.

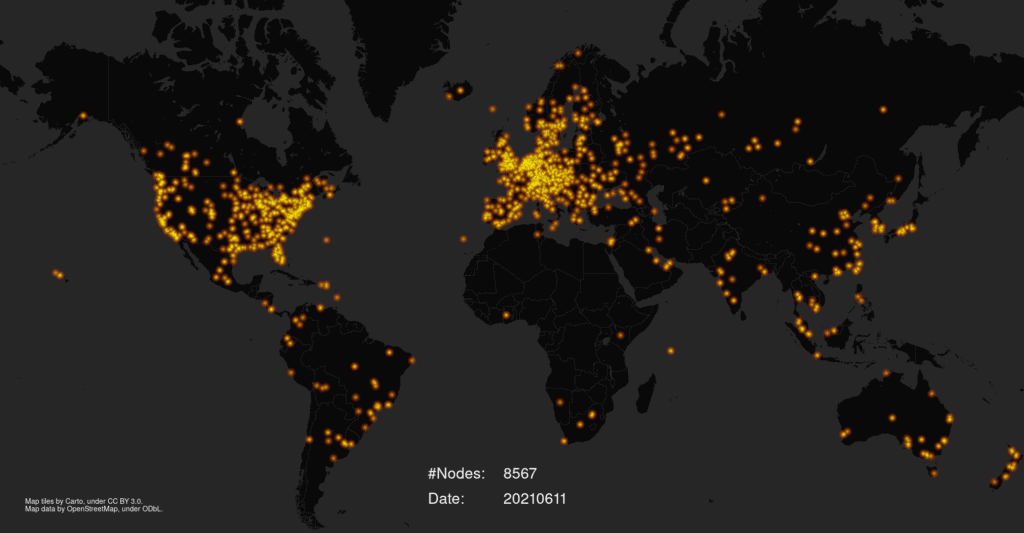

One of the key similarities, in turn, is the manner of global adoption of both entities. Both gold and Bitcoin have been adopted by the world as forms of wealth preservation. This is motivated by their independence from the economic situation of individual countries. They are also easily tradable outside of official circulation. Ultimately, more and more people are recognizing that both gold and Bitcoin can be an effective form of fighting inflation, providing hope for surviving any perturbation.