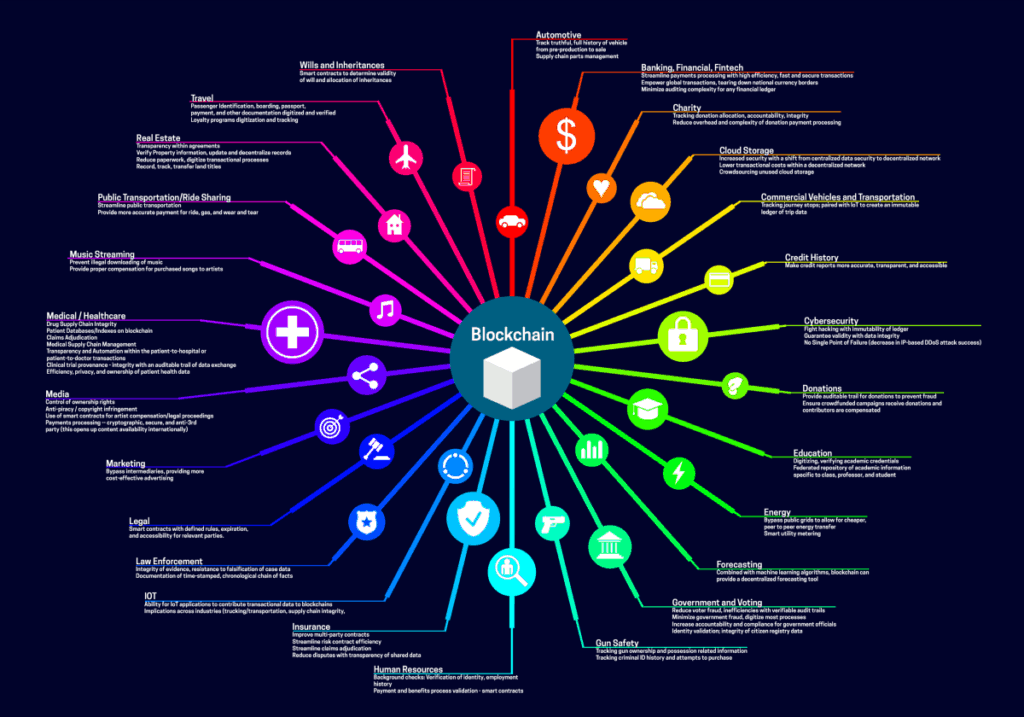

A few days ago, we witnessed spikes in the value of transactions on the Bitcoin network. This is the first such case in two years, when the price for a BTC transfer reached as high as $63. What is causing such a situation?

Is the NFT market disrupting Bitcoin?

The Bitcoin network is again seeing an increase in average transaction fees. On-chain metrics show that they have surpassed the $30 level, reaching a height last quoted in April 2021. Of course, back then, costs reached nearly $63, before falling dramatically.

The sharp increase in fees is taking a toll on the wallets of people who use Bitcoin for daily payments. Twitter user Marce Romero reports that in El Salvador, a $100 transaction cost more than $20. He also points out that those using the network to NFT should rethink their decisions, suggesting that there are more important use cases for the cryptocurrency. In his opinion, it is these people and their needs that are responsible for the jump in the value of the leading cryptocurrency’s transfer.

The technical reason for high fees on the BTC network

Romero’s statement is a suggestion that the main cause of the disruption is to be found in the Ordinals protocol, the tool that supports the creation of NFTs on the BTC network. It causes the network to be simply clogged, although still throughput. So how does its functioning look from a technical point of view?

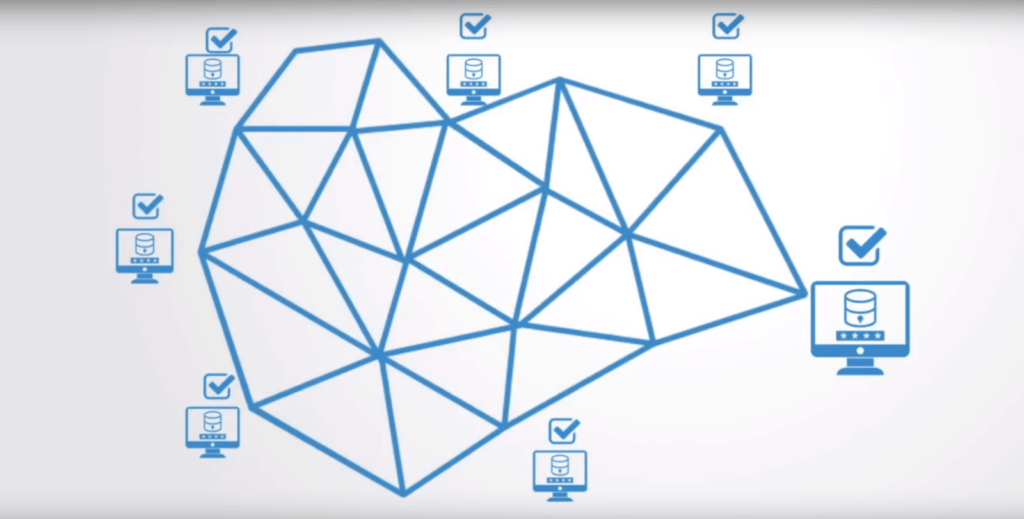

It all depends on the number of transactions that must be approved by miners, who solve complex problems using sophisticated computers. Miners are paid for their work in Bitcoins, so if they have a lot of work, transaction fees increase. Nowadays, a lot of people are using the network, so this affects the rising costs.

There is a way to bypass this hassle and opt to pay much lower costs. However, this carries the risk that this kind of transaction will be far in the queue for execution, as miners are more likely to execute those that will bring them a lucrative profit.

A bizarre situation – transaction fees give BTC miners more profit than block grant

With the recent spike in transaction fees, block number 788695 has become particularly special. It’s all due to the transaction fees of a single block, which surpassed block rewards for the first time since 2017. In this particular case, the fees amounted to 6.7 BTC, while the grant was “only” 6.25 BTC.

It is difficult to expect this situation to continue for a long time. After all, history shows that every dynamic jump in the value of transactions in the Bitcoin network, resulted in an equally dynamic decline.